FAQ for Tax Filing

The following guide has been prepared to help international students and scholars understand their tax responsibilities in the United States (U.S.). If you were present in the U.S. in 2023 in any immigration status other than B or WT/WB (ESTA), there is at least one tax form (IRS Form 8843) that you and any dependent family members must file with the U.S. Internal Revenue Service (IRS). To assist you with your tax filing, the HIO will provide you with discounted access to use the Sprintax tax preparation software.

For more information about your tax obligations, how to use Sprintax, and to find additional resources, please see the FAQ below.

Do I Have to File Taxes? What is Considered Income?

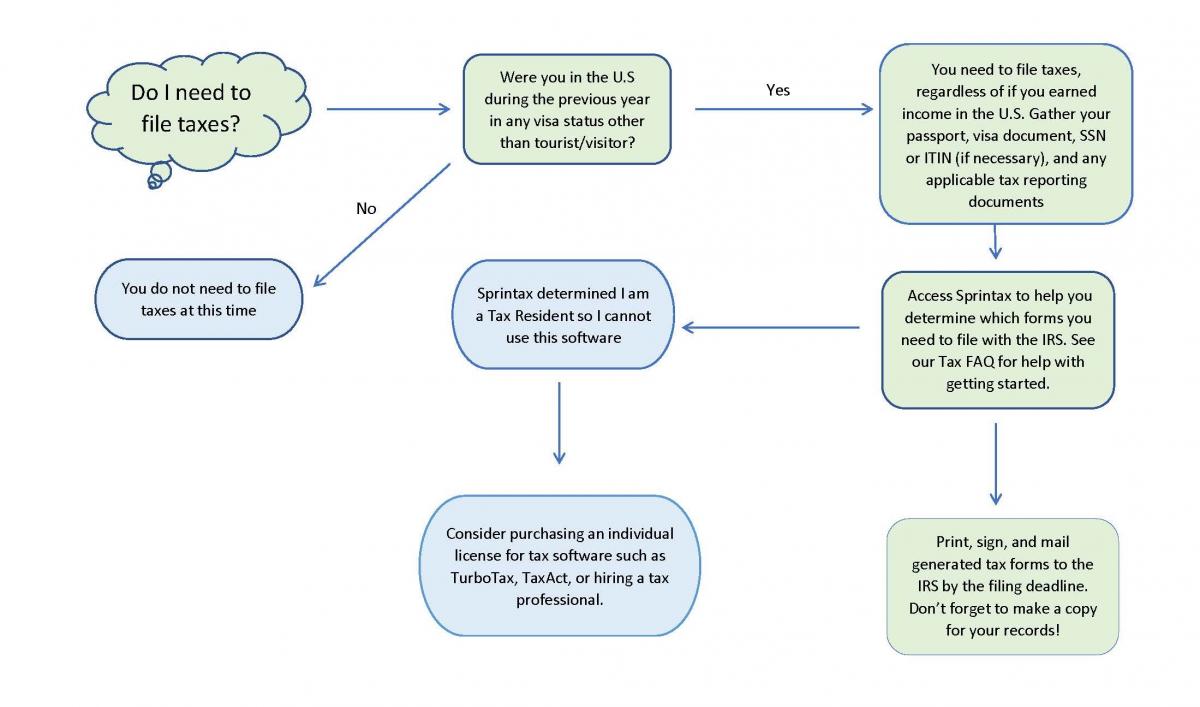

Do I have to file a tax return?

There is at least one tax form (IRS Form 8843) that you and any dependent family members must file if you held any U.S. immigration status other than tourist status (B or ESTA Visa Waiver) in 2023. You do not need to file any U.S. tax documents if you were not present in the U.S. during 2023 or only visited the U.S. with a tourist status.

What is IRS Form 8843?

All Tax Non-Residents must file IRS Form 8843 whether or not they had U.S. source income. In addition, if they had U.S. source income, they must also file IRS Form 1040-NR.

Do I need to file IRS Form 8843 for my U.S. citizen child?

No.

What is considered income for tax purposes?

Income generally refers to any money you have received from a U.S. source. This includes fellowships, stipends, salary, hourly pay, etc.

Do I need to file a tax return if I had taxes withheld from my paychecks?

Yes. You must file taxes to determine if you paid too much tax and are due a refund or if you will have to pay additional taxes if the amount withheld was insufficient to meet your tax liability.

My U.S. income is not taxed due to a tax treaty with my country. Do I still have to file a tax form?

Yes.

Do I have to file a Massachusetts State tax return?

Sprintax will determine if you need to file a Massachusetts tax return, or returns for other states.

Can I e-file my tax return?

The IRS recently opened e-filing to Tax Non-Residents. Sprintax Returns allows certain eligible nonresidents to e-file their federal tax return only. All state tax returns will need to be filed in hard copy. You can learn more about Sprintax Returns's e-filing capabilities, as well as who is eligible to e-file their federal tax returns, on the Sprintax Returns website.

If e-filing is available for you, you will not be required to send any hard copy documentation to the IRS to support your federal tax return unless specifically instructed to do so by the Sprintax software. You will still need to keep a copy of your tax reporting documents and tax return for your personal records.

Can I file my taxes from abroad?

Yes.

Am I a Resident or Non-Resident for Tax Purposes?

What’s the difference between Tax Non-Residents and Tax Residents?

Tax Non-Resident: May take advantage of any applicable tax treaty benefits and exemption from U.S. Social Security and Medicare/Medicaid taxes. Tax Non-Residents generally only pay tax on U.S.- source income. You can complete your tax forms using the Sprintax Returns preparation software.

Tax Resident: Cannot take advantage of any tax treaty benefits or other possible tax exemptions available for Tax Non-Residents. Sprintax Returns is not able to process returns for Tax Residents. Tax Residents generally follow the same tax rules as U.S. citizens and pay taxes on worldwide income.

How do I know if I am considered a Tax Non-Resident or Tax Resident?

Most incoming F and J visa holders are considered Non-Residents for tax purposes for their first few years in the U.S.

- F and J students are generally considered Non-Residents for tax purposes for the first five calendar years in the U.S.

- J-1 scholars are generally considered Non-Residents for tax purposes for the first two calendar years in the U.S.

The Sprintax Returns software will help you determine your tax residency status. If you are a Tax Non-Resident, you can use the Sprintax Returns software to complete your tax returns. If the software determines that you are a Tax Resident, you will not be able to use the Sprintax Returns software. Additional information on tax residency status is available at the Harvard Office of the Controller's website.

Can I keep my Tax Non-Resident status permanently?

Certain internationals in the U.S. may request to remain Tax Non-Residents beyond the standard time limits (generally five years for F & J students and two years for J scholars). Specific information on this is available at:

- Conditions for a Closer Connection to a Foreign Country

- The Closer Connection Exception to the Substantial Presence Test for Foreign Students

Can I use the software to complete my tax return if I am a Tax Resident?

No. If you have become a Tax Resident, you cannot use Sprintax Returns and must complete your tax return using a commercial software (e.g. TurboTax, TaxCut, TaxSlayer, TaxAct, etc.), or retain the services of a tax preparation specialist.

Do I Need an SSN or ITIN to File Taxes?

- If you had no U.S. source income in 2023, you do not need an SSN or ITIN, since you will only be filing IRS Form 8843.

- If you received scholarship/stipend/fellowship income in 2023, you will likely only need an ITIN.

- If you worked (were compensated for rendered services) in 2023, you must have an SSN.

The software may prompt you to apply for an ITIN application if necessary. DO NOT follow Sprintax Returns' ITIN instructions. Use the HIO's ITIN instructions.

To obtain an SSN, you must apply directly to the U.S. Social Security Administration. Please see the SSN application instructions for more information on how to apply for an SSN.

What is a "placeholder" number?

Tax reporting documents, such as the W-2 and 1042-S, cannot be issued without a personal identifying number. In most cases, that number is an SSN or ITIN. In the absence of an ITIN or SSN, however Harvard may assign a "placeholder”, which will be listed in the field for a SSN or ITIN on your W-2 or 1042-S. DO NOT use this number in lieu of an ITIN or SSN when completing your tax filing. If you did not personally apply for an SSN or ITIN, you DO NOT have one. An SSN or ITIN number is not issued to you unless you actually apply for one. Once a number has been issued to you, you must report the number to the Office of the Controller. NEVER email your SSN or ITIN.

Can I obtain ITINs for my dependents?

Yes. Your dependents may be eligible for state dependent credits.

Can I apply for an ITIN when I am not in the U.S.?

Applying from outside of the U.S. will be difficult but is possible.

Will Sprintax Returns Determine if I Need an SSN or ITIN?

Sprintax Returns may prompt you to apply for an ITIN if they determine that you need one. However, you should NOT follow their ITIN application instructions. Use the HIO instructions instead. Please note, if you apply for the ITIN through Sprintax Returns there will be an additional Sprintax Returns fee.

What if my ITIN application was rejected?

Due to long ITIN processing times, the HIO recommends that ITIN applicants delay filing or refiling for an ITIN if doing so after November. We would like for you to file your ITIN application jointly with your federal tax return. The ITIN application will be processed along with the tax return.

What happens if I file without an ITIN or SSN?

If you owe money to the IRS, they will process your return without an ITIN or SSN. If you are due a refund, the IRS will process your return but not process your refund. They will notify you that they will hold on to your refund until you provide them with an ITIN or SSN.

Do I also need an SSN/ITIN to file a state tax return?

State tax returns require an SSN or ITIN. You can file the state return without the number and then provide it to them when it is requested. However, Massachusetts will not issue refunds until you have provided an SSN or ITIN.

How Do I Use Sprintax Returns?

How do I access Sprintax Returns?

You must have an active Harvard Key to access Sprintax Returns . Once the software goes live, the HIO will alert all active students and scholars who were in the U.S. in 2023. You must access Sprintax Returns through the HIO link to receive the discount.

If you are not a current student, scholar, or student intern, and have an expired Harvard Key, please see the next question for instructions on how to access the software.

Sprintax Returns offers step by step guides on their YouTube page that contain good background information on tax filing in the U.S.

What if my Harvard Key expired last year?

You can access Sprintax Returns but you will need to request an access code by emailing the HIO. Please send your full name and a request for a tax software code to internationaloffice@harvard.edu.

What documents should I have ready?

- Your passport

- Your visa document (Form I-20, Form DS-2019, Form I-797, etc.)

- SSN or ITIN (if you have one) – see section below for more information about SSNs and ITINs

- Tax reporting documents (see section below) for U.S.- source income received in 2023.

Can I use Sprintax Returns for my dependents?

Yes. If you have trouble accessing the tax software for your dependents, please email the HIO at internationaloffice@harvard.edu to request an additional discount code.

My immigration status is sponsored by the Department of State/Fulbright/IIE. Can I still use Sprintax Returns?

You can only use these products if your Fulbright fellowship is NOT administered by IIE. IIE administered students can obtain tax assistance information here.

The software asks for the name of my program director. Whom should l list?

List your academic advisor or P.I., or you can list the contact information for the Harvard International Office:

1350 Massachusetts Avenue, Suite 864, Cambridge, MA 02138

What if I have questions about/issues with Sprintax Returns?

You can contact Sprintax support services through the “Ask Stacy” virtual tax expert available from within the program. If you need to chat with a person urgently type in "AGENT".

Why can’t anyone give me a direct answer when I ask “what should I put in this box on my tax return?”

Anyone who tells you how to complete your tax return could face legal liability should they provide inaccurate information. Only authorized tax preparers are protected from possible liability if a tax form is not completed properly on behalf of an individual. HIO Advisors cannot directly assist you with preparing your tax return because they are not trained tax professionals or authorized tax preparers.

Sprintax Returns has many paid services, should I use them?

Do not use the “Post-filing” or “ITIN Application” services in Sprintax Returns. The Post-filing service only provides assistance in the case of an IRS audit. You can purchase this service later, if needed. For the ITIN application, you must use the HIO instructions and should not apply using Sprintax Returns.

Troubleshooting Sprintax Returns

If you're having issues with Sprintax Returns the best way to reach their support services is through the “Ask Stacy” functionality in the software. Click here to view a variety of Sprintax Returns-supplied informational videos.

Tax Webinars with Sprintax Returns

This season, Sprintax Returns will be hosting a series of free open tax webinars to provide helpful information around nonresident tax filing obligations. You can find the details and registration links below.

2024 Sessions for Harvard affiliates only:

- Tuesday, March 19, 2024 12:00 PM EDT - Register here

2023-2024 General sessions for all international students and scholars nationwide:

- Thursday, March 28th @ 3pm EDT –Register here

- Wednesday, April 3rd @ 2pm EDT – Register here

- Thursday, April 11th @ 1pm EDT – Register here

- Monday, April 15th @ 11am EDT – Register here

The informational webinars will cover:

- An overview of tax filing for nonresident students and scholars

- Who must file a 2023 US tax return

- What income forms students/scholars may receive

- Forms that need to be completed and sent to the IRS

- Terms like FICA, ITIN and Form 1098-T

- What happens if you don’t file, or misfile

- State tax returns

- IRS stimulus payments

- Sprintax Returns overview

Am I required to File a Massachusetts State Tax Return or other State Tax Return?

You may be required to file a Massachusetts state return if you had taxable income according to the federal government. There is no need to file any Massachusetts state tax forms if the only federal tax form you had to complete was IRS Form 8843. The Sprintax Returns software will determine your Massachusetts tax obligation if you use it to prepare your federal tax return, and will prepare the state forms (if any) that you might need to file for a fee. Our license pays for the federal tax return but not the state tax returns.

Please refer to our Additional Tax Resources page for links to Massachusetts state tax forms and further information.

What if I moved to/from a different U.S state during the last calendar year?

If you lived or worked in more than one state during the preceding calendar year, you may be required to file a separate state tax return for each state you resided in. Sprintax Returns can assist with state filings for all 50 U.S. states.

When Should I File and When Are the Deadlines?

You should file your tax forms as soon as you have all the necessary materials. Please note that your forms must be accepted for mailing by the Post Office or e-filed on or before the dates listed below. Do not wait until the last minute to file your taxes! If you wait until the deadline, you must take your tax returns to the Post Office in person for mailing.

- IRS Form 1040-NR with Form 8843 – April 17, 2024 (June 15, 2024 if you did not receive wages)

- Massachusetts Form NR/PYR (if required) – April 17, 2024

- Form 8843 only – June 15, 2024

I am not able to file taxes now. Can I get an extension?

It is possible to file a Form 4868 to request a six-month extension from the IRS. You may file for an extension if you owe tax, but you must pay any estimated tax liability by the standard filing deadline or you will incur significant penalties and interest. Sprintax Returns software access is available year-round.

What if I didn’t file taxes last year?

You must prepare a separate tax filing for each tax year. This means you cannot include last year’s income information on the current year’s tax forms. Sprintax Returns provides access to 2022, 2021, and 2020 tax forms. For earlier years, go to the IRS Prior Year Forms and Publications and print a Form 1040-NR for the tax year you need to file. Be sure to also get the preparation instructions for that year's Forms 1040NR, because the tax rates and exemption amounts are different for each tax year.

What happens if I don’t file my taxes?

If you owe money, you will incur fees and penalties assessed by the IRS and state governments. If you are due a refund, you will not be assessed fees and penalties. However, you must claim your refund within three years or you will forfeit the refund to the U.S. Government.

Common Tax Form/Tax Document Questions

Will I receive any tax reporting documents?

If you had no U.S.-source income in 2023, you will not receive any tax reporting documents. It is possible to receive more than one type of tax reporting document if you received more than one type of income from a U.S. source (wages plus a stipend, for example). The type of document(s) you receive depends on the type of funding you received (refer to the chart below).

Please note, you will not receive any of the below documents if the only funding you received from Harvard was a tuition fellowship that was applied directly to your term bill or if you received no US source funding.

I received funding from a U.S. source. What tax reporting document(s) should I expect?

The HIO does not issue tax reporting documents. The Harvard Office of the Controller issues Forms W-2 and 1042-S for Harvard-based income. If you worked for another U.S. employer in 2023 you will receive a tax reporting document from that employer.

Please review the Office of the Controller's website for additional information.

| IRS Form W-2 |

Issued to those who had U.S-based employment (including OPT/CPT employment); should have been distributed to you by January 31, 2024. |

| IRS Form 1042-S |

All employees who claimed a tax treaty exemption; should be available from International Payee Tax Compliance by March 15, 2024. OR All Tax Non Resident students/scholars who received a non-service scholarship/fellowship in excess of tuition/required fees/books and supplies- regardless of whether or not tax was withheld; should be available from International Payee Tax Compliance by March 15, 2024. |

|

1095- (A, B, or C) |

Form 1095-B is used to report certain health insurance information to the IRS and to taxpayers. |

| MASS DOR Form 1099-HC | Serves as proof of health insurance coverage and would be used to complete the Schedule HC form on a Massachusetts State tax return. Note that not all international students and scholars need to complete a state tax return. |

You might also receive a 1099-INT or 1099-MISC if you earned interest income from a U.S. bank account. Do not prepare your tax return until you have all your applicable tax documents. It’s important to wait until you have everything you need for a complete and accurate filing. You should contact the relevant employer/payer if forms are not received within the timeframes noted above.

All employees and stipendees must keep their home address listed in PeopleSoft current. This will ensure that your Form W-2 (if applicable) and any other official documents are mailed to the correct address. Students must update their address in my.harvard, which will automatically update their PeopleSoft address.

What if I had multiple jobs/employers?

You must wait to file your tax return until you have received all of your tax reporting documents for your various U.S. employment experiences.

When does Harvard Issue Tax Reporting Documents?

Please review Harvard's tax reporting document information.

The W-2 or 1042-S that I received lists incorrect information. How can I obtain corrected documents?

If the form was issued by Harvard, please contact the Office of the Controller to correct your W-2 or 1042-S. If you worked elsewhere, contact your employer to request a corrected W-2 or 1042-S.

I received a 1099-HC. What is it? Does this mean I have to file a state tax return?

This form is used by Massachusetts to determine if you have met the state insurance requirements. You will only use this form if you are required to file a Massachusetts tax return. Contact your health insurance provider if you need this form but did not receive it. It is important to note that not everyone will need to file a Massachusetts state tax form and that Sprintax Returns will assist in determining whether you will file a state tax return.

I received a 1098-A, B, or C. What is it? Does this mean I have to file a federal tax return?

This form is used by the IRS to determine if you have met the federal health insurance requirements. You will only use this form if you must file a federal tax return. Contact your health insurance provider if you need this form but did not receive it. Sprintax Returns will assist in determining your filing status.

I received a 1098-T. What is it? Does this mean I have to file a tax return?

The 1098-T is a tuition payment statement that can be used by those who may be eligible for an educational tax credit. The Student Accounts Office issues the Form 1098-T. Sprintax will determine if you can use the form for your federal tax filing.

I completed my tax return and already mailed it in. Now I received a 1042-S from Harvard. What should I do?

You will have to file an amended tax return using IRS Form 1040X. Sprintax Returns can assist you with amended returns, or you may access the Form 1040X and instructions on the IRS website.

I have not received my W-2 or 1042-S. What should I do?

You will only receive a W-2 or 1042-S if you had U.S.- source income in 2023. If you received income from Harvard, but did not receive a tax reporting document, you should contact the Office of the Controller or request issuance of duplicate forms using the following web sites:

- W-2

- 1042-S (email FAD_IPTC@harvard.edu and be sure to include your full name and mailing address)

If you are abroad, you can list your foreign address in the U.S. address fields or the comment field. If you should have received a tax reporting document from another U.S. employer, you should contact their payroll office.

Will I receive a 1042-S?

Not everyone receives a 1042-S. It depends on your tax status and your income. The following situations describe when a 1042-S would be issued. Please review the Office of the Controller's website for additional information.

- If you received wages or salary on which you claimed a tax treaty exemption.

- If you received a scholarship or fellowship (no services performed), regardless of whether tax was deducted or whether you claimed a tax treaty exemption. Please note that if you only received tuition, required fees, or a book allowance applied to your term bill, you will not receive any tax reporting documents.

- If you received income from any prizes or awards.

I received a tuition scholarship from Harvard. Will I receive a W-2 or 1042-S?

No. If you only received tuition, required fees, or a book allowance applied to your term bill, you will not receive any tax reporting documents.

I am Canadian and I need information to complete a TL11A. Who can I contact for assistance?

Student Financial Services will assist you in completing the TL11A and the TL11D. All requests should be submitted to student_billing@harvard.edu and be sent from your Harvard email address (for identity verification purposes). You can download a TL11A from the Canada Revenue Agency's website.

I'm Eligible for a Tax Refund. What Now?

What is the best method for receiving my tax refund?

You have the option of requesting a paper check or direct deposit into your U.S. bank account. Using direct deposit is quicker and eliminates the possibility of your refund check being misdirected if you move or leave the U.S.

Where’s my refund? I filed for a refund of overpaid taxes, but I haven’t received the payment yet.

Go to the IRS “Where's My Refund?” online tool to track your refund.

When will I receive my refund?

The IRS is severely backlogged and it may them many months to process your tax return and any possible refund.

I overpaid Social Security and Medicare taxes. Am I eligible for a refund of what I overpaid?

Possibly. Please refer to the Figuring Your Taxes section of IRS Publication 519 for general information. If you are eligible, you will need to file IRS Form 843 (Instructions).

How to File Taxes from Abroad

Tax returns that can be e-filed generally do not require any documents be mailed to the IRS. If you must mail a return or documentation, the materials must be postmarked by the required tax filing due date. The IRS adds this caution:

A tax return delivered by the U.S. mail or a designated delivery service that is postmarked or dated by the delivery service on or before the due date is considered to have been filed on or before that date. You can use certain private delivery services designated by the IRS to meet the "timely mailing as timely filing/paying" rule for tax returns and payments.

The list of services can be found on the IRS website. If you are filing from abroad, you must use UPS, FedEx, or DHL to ship your documents to the IRS in order for the IRS to consider the documents timely mailed.

Departing Harvard

You will need to file a U.S. tax return from abroad if you earned U.S. income in 2023 and have since departed the U.S. You will no longer receive automatic communications from the HIO after your departure. You can access Sprintax Returns but you will need to request an access code by emailing the HIO. Please send your full name and a request for a tax software code to internationaloffice@harvard.edu.

- Students – Make sure that your permanent mailing and email addresses are listed in My.Harvard.

- Scholars - Make sure that your permanent mailing and email addresses are listed in Peoplesoft

Harvard will need this information to send your tax reporting documents.

What Other Resources are Available?

Refer to our Additional Tax Resources information page.

Beware of Tax Scams and Identity Theft

Tax season is the time of year when scammers attempt to extort money from people or steal identities by pretending to be IRS officials. The IRS provides information to assist people with identifying scams. Please refer to the links below and note that the IRS NEVER calls individuals regarding their taxes, so if someone calls you claiming to be from the IRS, hang up! It is definitely a scam. Also, NEVER email your social security number or give it to someone you do not know over the phone.

-

Identity Protection: Prevention, Detection and Victim Assistance

-

For more information about how to avoid identity theft please review the HUPD website or check the resources here.

The tax resources offered by the HIO are provided so that international members of the Harvard community can make informed personal decisions concerning their taxes. HIO advisors are not trained tax specialists and cannot provide individual advice on taxes. By using these tax assistance programs, you acknowledge that Harvard University is not liable for any errors and incidental or consequential damages in connection with the furnishing, performance or use by you of these on-line systems, on-line HELP and/or examples contained therein. You should seek professional tax advice from a qualified accountant or attorney if you have questions or need clarification.